Company Overview

Costco Wholesale Corporation, known as Costco, is a multinational corporation that manages a chain of warehouse clubs. Costco was founded by James Sinegal and Jeffrey H. Brotman in 1976 in San Diego, California. It is known as one of the largest retail chains in the world, with warehouse locations throughout the U.S., Canada, Mexico, and the U.K. to name a few.

Costco has a membership-based business model where customers pay an annual fee to have access to their products. Costco sells groceries and cleaning supplies to electronics and furniture. Different membership tiers affect the access to discounts.

Costco’s unique value proposition (UVP) lies in its ability to offer quality products at low prices. Their membership model builds a sense of exclusivity and specialty for members. Its private label, Kirkland Signature, is also known to offer high quality products.

Costco utilizes the revenue from membership fees to maintain such low prices. It has over 60% of warehouse club market share as of 2022, compared to Sam’s Club at 31% and BJ’s at 7%. On the other hand, as of 2023, Costco has 9.2% of the grocery retail industry. The giant has added 100 stores in Canada over the past three years and has also debuted into Australia, New Zealand, Spain, France, and many other countries around the world.

With recent issues of members sharing their membership cards with family and friends, Costco is cracking down on its entrance procedure. To reduce crowding, the store decided to have shoppers’ IDs scanned before entering.

Industry Overview

The discounted retail industry, of which Costco is a major competitor, plays a significant role in the U.S. economy. This industry runs on a low-cost business model by purchasing goods in bulk and streamlining supply chains to sell at competitive prices. Although most small brick and mortar stores have a limited assortment of products, Costco has a competitive edge with its wide variety of products.

According to Berkshire Hathaway, this industry is expected to grow 4.4% in compound annual growth rate (CAGR) between 2021 and 2026. This growth will outpace the projected 3.3% CAGR in the supermarket industry. Costco has a 379.87 billion dollar market cap, standing as proof of the pivotal role this industry plays in the U.S. economy.

Retail sales grew in February by 0.6%. With increases in employment and wages, consumer spending is growing. As consumers increasingly prioritize value and affordability, the discount retail industry is leveraging enhanced data analytics to better attract low-to-middle income families. Furthermore, this era of evolving e-commerce is prompting companies like Costco to adopt stronger online roles with incentives such as 2-day delivery services.

If inflation continues to slow, the rise in consumer confidence will continue to push up consumer spending. However, speculation over economic downturns questions the vulnerability of spending habits for the next few quarters. Discount retailers also must adapt to these changes by updating their e-commerce platforms, implementing new data security measures, and improving the in-store experience.

This industry offers various employment opportunities such as store managers, customer experience representatives, warehouse associates, inventory managers, and many others. These positions often don’t require college degrees. Currently, millions of workers in the U.S. alone are employed in this industry.

Accompanying its abundance of job opportunities, the discounted retail industry has great influence on America’s economy. Their competitive prices force other retailers to improve their efficiency and lower prices as well. Therefore, even underserved communities have access to better quality goods. Overall, the positive ripple effects of the discounted retail industry will cause the U.S. economy to be stronger and robust.

Despite the numerous benefits, the discounted retail industry faces many challenges. Local businesses find it harder to compete with the lower prices and varied assortment of products. Moreover, the business model of this industry promotes a supply chain system that paves way for greater environmental degradation. It is the invisible cost we pay for having low prices. However, while challenges remain, companies like Costco have the capacity to innovate and adopt more sustainable practices in the industry. As such, the sector’s future looks promising, and will offer great value for both consumers and investors.

Financial Overview

In 2023, Costco’s revenue reached a peak of $242.29 billion, representing a 6.75% increase in revenue from the previous year. This growth can be attributed to higher membership volume and sales volume, as well as the opening of more locations and the good economic environment.

Notably, however, is the fact that Costco’s revenue decreased only one year in the past, from 2008 to 2009 during the great recession, and that too only by a negligible amount. Costco’s source of revenue is seemingly recession proof, with consistent growth from its founding in 1983 to the present day. Since the great recession, Costco’s revenue and profits have only grown, even through the COVID pandemic and afterwards, with the help of a strong, loyal customer base.

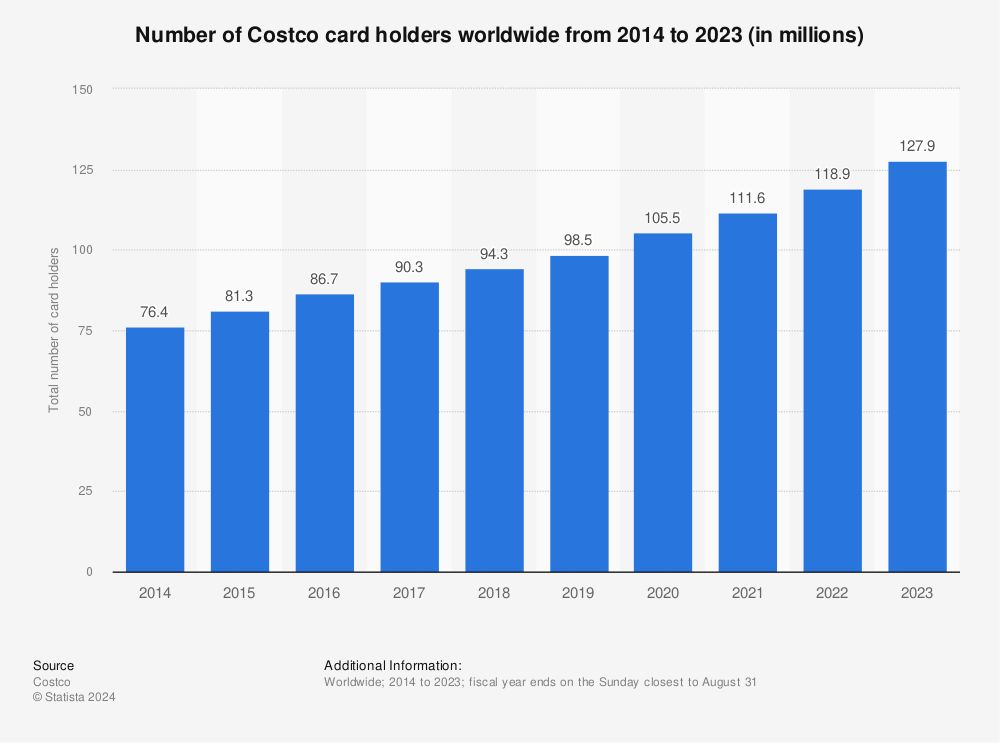

Costco Memberships have also increased similarly, with the total number of cardholders growing by 9,000 from 118,900 to 127,900. Not only that, but the renewal rate was similarly high, at above 90% worldwide and 92% for the U.S. and Canada, its principal sources of revenue. Costco Membership prices have not been increased since 2017, so there is potential there as well.

Costco itself does highlight several concerns, one of which is the loss of customer loyalty, though this fear seems mostly unfounded, as Costco has a strong support base and has even grown to become important culturally. Another unfounded concern that they seem to have is their reliance on the U.S. and Canada’s economic environment, which seems unnecessary considering their recession-proof industry and their clientele, which tends to be of a higher income bracket.

Some further highlights include:

- 26 new warehouses in the year of 2023, 13 in the U.S. and 13 internationally

- Net Sales increased by 7%, 3% as a result of comparable sales and the rest from new warehouses

- Membership fee revenue increased 8%

- SG&A expenses as a percentage of sales increased .2%, significant for the industry, primarily as a result of higher wages

- Effective tax rate increased to 25.9% from 24.6%

- EPS increased 8%

- 13% increase in quarterly cash dividend as of April 2023

An important fact to note is that Membership fee revenue could be said to make up most of the profit margin, highlighting Costco’s model of providing extremely low cost goods at near cost, while primarily making profit through memberships – which have been steadily growing.

Investment Thesis

Costco Wholesale Corporation stands as a dominant player in the discounted retail industry, bolstered by numerous advantages over its competitors, strong fundamentals, and a solid growth history. Despite these strengths, the current stock price of $838.18 per share (as of July 19th) reflects a PE ratio of 51, which appears overvalued given its growth metrics. A more realistic PE ratio of 40 aligns better with Costco’s true value, bringing the stock price closer to our DCF valuation of $556.80.

Key Points:

Resilient Business Model – Costco’s membership-based business model ensures a steady stream of revenue from annual fees, contributing heavily to its profit margins. With a membership renewal rate of 90%, Costco has truly become recession proof with remarkable stability and customer loyalty. Risks for Costco are very low, and are mostly surrounding loss of growth, rather than of revenue.

Brand Loyalty and Reputation – Costco has successfully built a reputable brand and culture, fostering loyalty among both customers and employees. This strong brand equity is a crucial factor in its sustained growth and market dominance.

Recent Strategic Moves – The recent announcement of a membership price hike is expected to bolster revenue without significantly impacting membership renewal rates, given the high loyalty and satisfaction among Costco members.

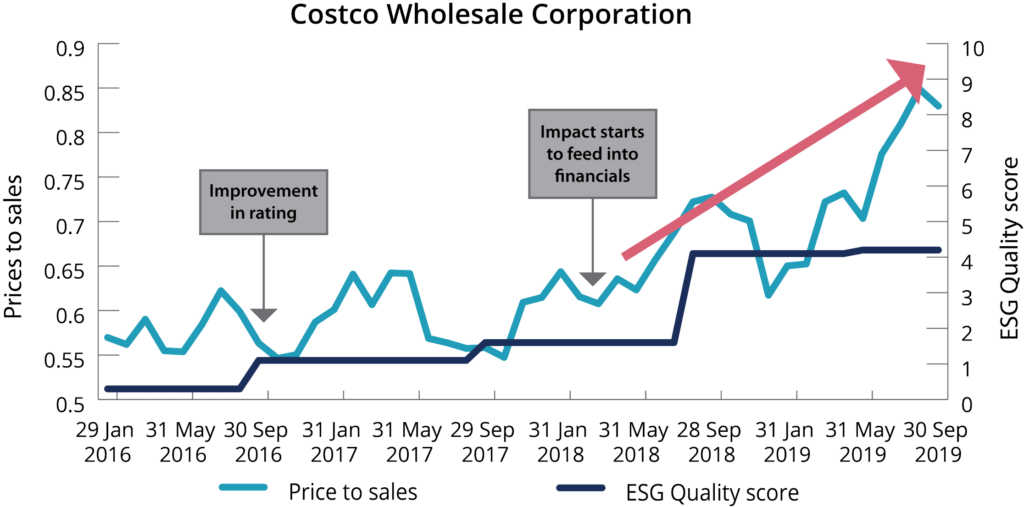

ESG Considerations – Costco has no significant ESG concerns, consistently demonstrating excellence in leadership, employee welfare, and sustainability efforts. The company’s commitment to social responsibility and ethical business practices further enhances its investment appeal.

ESG Considerations

Environmental:

Costco is not known for its excellence in sustainability like it is socially and in its governance. However, it has still made several commitments towards this goal. The company is committed to reducing its carbon footprint, and has even reported a decrease in certain types of emissions despite the company itself growing aggressively. Costco has come to consider deeply what types of materials it should use in construction, what kinds of energy it should be purchasing, and what supplies they are using in regards to their environmental impact.

Something of note should be Costco’s extensive gasoline sales, which may impact any opinion that Costco may be improving or becoming environmentally conservative. Costco must navigate the dual goal of increasing sales while decreasing emissions, a difficult goal, though not as difficult as for an energy company.

Social:

Costco is famous for its social responsibility compared to others in its industry, who are known infamously. Costco is known for its commitment to employee welfare, raising its minimum wage to 17$ per hour while offering excellent benefits all around, while continuing to be focusing on DEI (50% of costco’s new hires in 2023 were women). Costco continues to actively engage with the communities it operates in, supporting food donation programs, disaster relief efforts, and educational scholarships.

Costco also has a strong track record in regards to its product safety and quality, while also offering generous policies to its customers for return and refunds.

Governance:

The Board of Directors have been a key part of the governance of Costco, and their leadership has reflected down the ranks as well. Governance at Costco is focused on ethical business practices, a focus on high quality/low prices, and engages frequently with society at large.

Costco actively engages with its shareholders, customers, and its stakeholders, and provides transparent reporting on many of its initiatives. Costco also conducts regular audits and assessments, not only on its own employees and subsidiaries, but also on its business partners and suppliers.

Investment Risks

Current Valuation:

Currently, Costco shares have a tremendously high P/E ratio, much bigger than that of the S&P 500 and of Costco’s competitors. This is about as expensive as the shares have been in the past decade. Investors are steadily bidding up the price because of its great financial performance. And since investors in general aren’t fearful of Costco’s future performance, most investors are continuing the flow. However, these expectations pressure the company to generate stronger gains in the future. Therefore, investors should be a little cautious before investing into Costco long-term, especially if they are looking to beat the market.

E-commerce Developments:

After the pandemic, the world has shifted to online shopping. Other retail giants like Amazon and Walmart are dominating the e-commerce space. This is causing foot traffic and sales to comparatively drop in Costco’s physical stores. To keep up with competition, Costco must pay more attention to its online services and the way it delivers orders to customers’ doors in a quick and efficient manner.

Valuation

Considering the aforementioned factors, we recommend a price target of $650 for Costco stock. This target aligns more closely with our valuation analysis and reflects a more accurate assessment of Costco’s financial value and growth potential. It is slightly higher than a PE of 40, which we believe to be justified due to its growth and low risk business model.