Company Overview

Dell Inc. is an American technology company that develops personal computers and other IT infrastructure such as desktops, mobiles, workstations, storage devices, and cloud services. Dell was founded by Michael S. Dell in 1984. Dell entered the world of IT as a college student, studying at UT Austin, when he began a business of upgrading and selling personal computers to other students. From there, he found an interest in selling computers to consumers directly, instead of through conventional retail stores. What started as a $1,000 investment turned into a public company that raised $30 million in its initial public offering (IPO) in 1988.

In the early 2000s, Dell expanded its services into the servers, storage devices, and networking equipment spaces, leading to global recognition. In 2016, Dell merged with EMC Corporation, an American company that specialized in data storage and information security, establishing Dell Technologies. The company currently sells to numerous countries around the world. It primarily receives sales from its online website channel and from authorized resellers or distributors. In many regions Dell works with electronics retailers like Best Buy and Walmart to sell in physical stores.

As visited before, Dell Technologies operates on a direct-sales approach by reaching its customers from its online platform. This allows customers to customize their orders rather than choose from a bulk order at a retail store. Dell also saves on inventory costs and wastage.

It has an extremely efficient supply chain system that fulfills customer orders promptly. Dell gets the largest revenue from personal computers, desktops, and workstations. The next largest revenue stream comes from the sale of software such as software licenses, monitors, and printers. Dell also offers a rewards program where members earn and redeem points for future purchases.

Dell technologies reinvests a significant portion of its revenue into R&D to further develop and maintain its cloud computing, artificial intelligence, and cybersecurity services. As of the second quarter of 2023, Dell holds a 17.4% of the global PC unit shipment industry, a 18.19% share of the computer hardware market, and 14.51% of the technology sector. Its commitment to innovation and customer satisfaction has solidified its position as a leader in the technology industry. This pursuit of adaptability allows Dell Technologies to remain a key player in the global tech landscape, delivering value to its shareholders and customers alike.

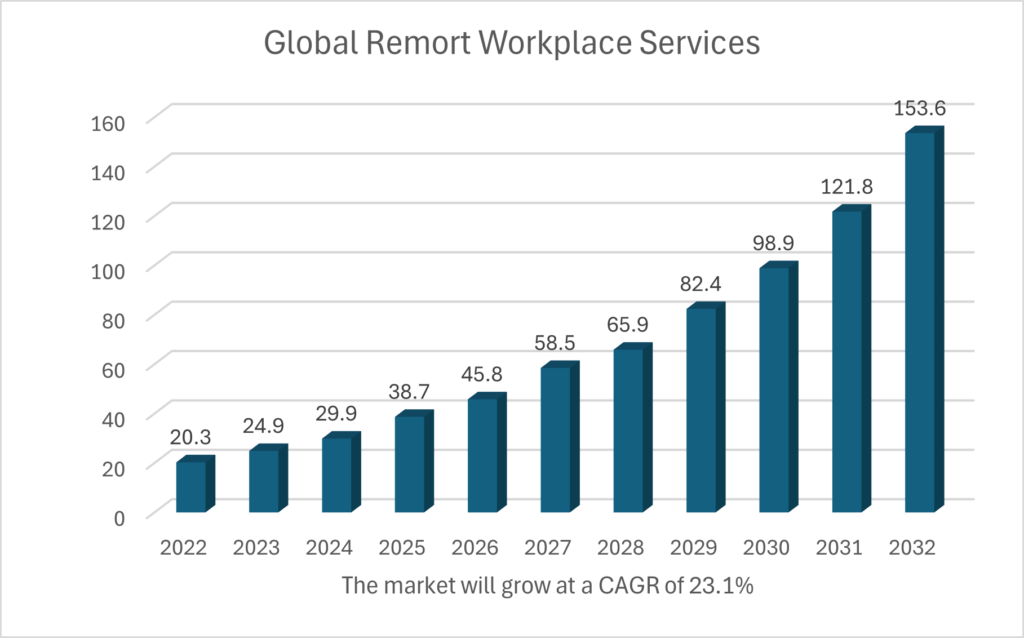

Industry overview

Dell Technologies operates in the IT services industry with a significant presence in the hardware, IT enterprise solutions, cybersecurity, and cloud computing sectors. The technology sector is characterized by rapid innovation, intense competition, and significant investment in research and development (R&D). Companies are developing more sophisticated algorithms, improving data processing capabilities, and creating smarter, more interconnected devices. Dell Technologies, in particular, is advancing its cloud computing and AI offerings, ensuring robust cybersecurity measures to protect against evolving threats.

The IT industry operates on diverse business models tailored to its vast array of services and products. Companies like Dell Technologies often adopt a combination of direct sales, e-commerce platforms, and channel partnerships with authorized resellers and distributors. This multifaceted approach allows IT companies to cater to a broad range of customers, from individual consumers to large enterprises, providing hardware, software, and comprehensive IT services. Revenue streams are primarily generated from sales of physical products (e.g., computers, servers, storage devices) and recurring revenue from services (e.g., cloud computing, cybersecurity, software subscriptions).

This industry significantly impacts lifestyles by enhancing connectivity, productivity, and convenience through communication and access to information. These advancements facilitate remote work, e-commerce, and smart home technologies, fundamentally altering how individuals interact with technology daily. The IT industry offers roles such as software developers, network engineers, data scientists, cybersecurity analysts, IT consultants, and project managers. These positions are essential for maintaining and advancing technological infrastructure, developing new software and applications, and ensuring the security and efficiency of IT systems.

The IT industry faces several challenges, including rapid technological changes, cybersecurity threats, and regulatory compliance issues. Companies must continuously innovate to stay competitive while safeguarding against data breaches and cyberattacks. Additionally, navigating complex global regulations and ensuring data privacy remain critical concerns. Despite these hurdles, the future of the IT industry looks promising. As digital transformation accelerates, the demand for innovative IT solutions will continue to grow. Companies like Dell Technologies are well-positioned to lead in this evolving landscape, driving technological progress and meeting the needs of a digital-first world.

Financials Review

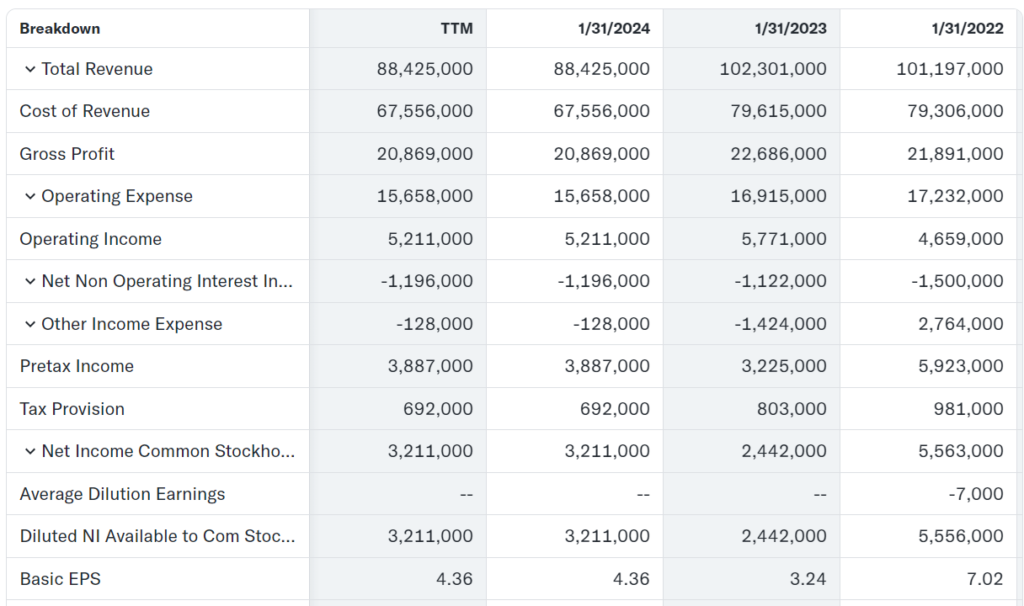

In 2023, Dell Technologies reported annual revenue of $102.3 billion, marking a 1.09% increase from the previous year’s revenue of $101.2 billion. This growth was primarily driven by the Infrastructure Solutions Group (ISG), which saw significant gains. However, this increase was partially offset by a decline in the Client Solutions Group (CSG).

Revenue Breakdown:

- Servers and Networking: 20.4%

- Storage Solutions: 17.96%

- Commercial Solutions: 45.56%

- Consumer Solutions: 12.66%

Profitability Metrics

As of October 2023, Dell’s gross profit margin stood at 23.14%, showing a competitive edge over Lenovo Group at 17.50% and slightly lower than HP at 23.72%. This year, Dell’s gross margin increased by 4%, attributed to the growth in ISG, particularly in revenue from server, networking, and storage offerings.

SG&A Expense Reduction

Dell’s Selling, General, and Administrative (SG&A) expenses decreased by 4% during Fiscal 2023. This reduction was mainly due to decreases in the amortization of intangible assets and outside services expenses. The company spent less on non-physical assets such as patents and copyrights, and reduced costs for third-party services like consulting and legal services.

Venture Capital Investments

Dell Tech Capital, Dell’s venture capital investment arm, focuses on emerging technologies in storage, software-defined networking, security, artificial intelligence (AI), and more. Despite facing a net loss of $206 million in investments, this is in line with overall public equity market declines.

Research and Development

Dell increased its R&D expenses by 8% this year, largely due to higher employee compensation and benefits. This investment underscores Dell’s commitment to innovation and maintaining a competitive edge in emerging technologies.

Shareholder Returns

Dell is committed to returning capital to shareholders through stock repurchase programs and dividend payments, demonstrating a strong focus on shareholder value.

ESG Concerns

Environmental:

As a leading technology provider that has supply chain networks around the globe, Dell is doing its best to mitigate climate change. They are strengthening their GHG emissions targets and have projected a 40.6% reduction in FY24. They have sourced 61.5% of electricity generated using renewable sources. Currently, 14.1% of their products are made from renewable material, and they are aiming for 50% to be made from recycled material by 2030. 96.4% of their packaging is from recycled material.

Social:

Their main social goal is to reduce the digital divide for marginalized societies. 51.5% of them are girls, women, or minorities. They have digitally included 396M people in FY24 and are aiming to reach 1B by 2030. 48% of Dell employees are volunteering in their communities. They have partnered with 535 nonprofits for digital transformation activities. 35% of Dell employees and 24% of those in leadership positions identify as women. These trajectories show that Dell is acting on its beliefs of equal and respectful treatment of its stakeholders.

Governance:

Dell wants their customers to build trust in Dell products and services. The company is introducing a Zero Trust solution, a security framework that protects the organization’s IT environment by making sure not to trust any entity by default. By 2025, Dell wants to publish a software bill of materials for 100% of the products sold to prove their transparency.

Investment Thesis

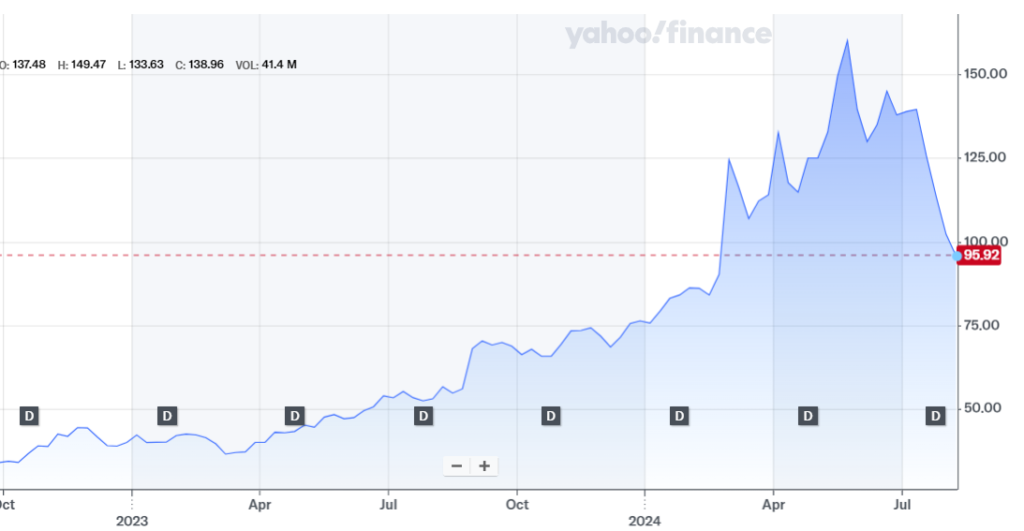

Dell Technologies is a formidable player in the IT industry, renowned for its strong fundamentals, innovative capabilities, and robust market presence. Despite these strengths, the current stock price reflects certain market perceptions that might not fully capture Dell’s intrinsic value. Our DCF valuation of $272 indicates a more accurate assessment of Dell’s financial health and growth prospects.

Resilient Business Model

Dell’s diverse business model, combining direct sales, e-commerce, and channel partnerships, ensures steady revenue streams. Its focus on customization and efficient supply chain management enhances customer satisfaction and operational efficiency. The company’s strategic emphasis on R&D investment positions it well to capitalize on emerging technologies such as cloud computing, AI, and cybersecurity.

Strong Market Position and Brand Loyalty

Dell’s reputation for quality and reliability has cultivated strong brand loyalty among consumers and enterprises alike. The company holds significant market shares in the global PC unit shipment, computer hardware, and broader technology sectors. Its commitment to innovation and customer-centric approach solidifies its market dominance and fosters long-term customer relationships.

Strategic Growth Initiatives

Dell’s venture capital arm, Dell Tech Capital, is actively investing in cutting-edge technologies, ensuring that the company remains at the forefront of industry advancements. Additionally, Dell’s increased R&D spending highlights its focus on developing innovative solutions to meet future market demands, thereby driving sustained growth.

ESG Considerations

Dell is dedicated to reducing its environmental footprint and promoting social equity. The company’s initiatives to source renewable energy, increase the use of recycled materials, and bridge the digital divide demonstrate its commitment to sustainability and social responsibility. Dell’s governance practices, including the implementation of Zero Trust security solutions, further enhance its credibility and trustworthiness in the market.

Investment Risks

- Adverse Global Economy

Global economic uncertainty may adversely affect the demand for Dell products and services. A few larger customers decreased their IT spending in FY24 due to the geopolitical volatility present as a result of military tensions in the Middle East and Asia-Pacific regions. Dell is also being affected by trade disputes between the U.S. and China along with supply chain crises present since the pandemic.

- Competition

The world is currently seeing rapid changes and growth in the hardware and software services industries. Dell is working hard to offer competitive prices while maintaining the company’s brand. If their competitors offer better prices or more quality services, it may significantly deplete the company’s revenue.

- Single-Source vendors

Dell has many single-source or limited-source suppliers as they are more available and advantageous in terms of quality and performance as opposed to multiple-source suppliers. However, they may be more vulnerable to delays in shipping these intermediate goods. Also, if these components in the goods that are sold to customers are damaged, it is very difficult to replace them.

Valuation

Given these factors, we recommend a price target of $272.06 for Dell Technologies stock. This target aligns with our DCF valuation and reflects a more accurate representation of Dell’s financial value and growth potential. The recommendation is based on Dell’s resilient business model, strong market position, strategic growth initiatives, and commitment to ESG principles, positioning the company for long-term success in the evolving IT landscape.